Covid-19 is impacting the European plastics industry in various ways. More than three quarters of plastics companies reported lower sales this spring compared to April 2019, with around half facing a sales decrease of at least 20%. While the public backlash against plastics has been a worry for most of the plastics sector over the past several years, a majority of European businesses stated that the pandemic is positively impacting the public image of plastics.

In May 2020, PIE – Plastics Information Europe conducted a flash survey on business performance to gain insight into business trends in the European plastics industry during the coronavirus pandemic. The current results are based on data from 155 participants from 29 countries.

Among the plastics companies reporting lower sales compared to April 2019, the smallest enterprises appear harder hit, with almost 60% saying sales fell at least 20%, compared to around 45% of mid- to large-sized firms. By region, respondents in the Nordic countries were notable since almost half reported higher sales compared to April last year. A 72% share of plastics processors are dealing with falling sales. Processors with business in the packaging sector fared better, with around 40% reporting increased sales.

Looking ahead, order activity for this summer is reflecting the general state of the European economy and does not seem promising across sectors and regions. Only 16% of respondents are expecting an increase in customer orders in the second quarter of 2020 compared to the same period in 2019. Around 40% of companies expect order volume in the next quarter to be at least 20% down year on year. Plastics converters involved with packaging appear most optimistic, with nearly 40% predicting higher ordering in Q2 2020, while plastics producers seem much more pessimistic with the ordering outlook.

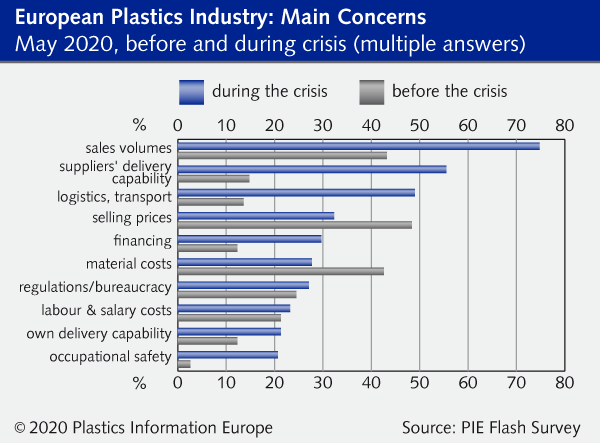

Before the coronavirus crisis, the top three concerns were selling prices, sales volume and material costs. However, only sales volume has survived in this tier during the crisis, moving to the top position (75%). The second and third main concerns are now suppliers’ delivery capability (55%) and logistics (49%) – highlighting the effects that the shutdowns, border controls and other problems have had on plastics companies.

Single-use plastic items like medical masks and some food packaging are now being used in the same sentence with “essential” and valued for their roles in preventing the spread of the coronavirus. The public is now viewing plastics with regard to the properties that were always present – materials for protection, hygiene and medical supplies – but which were overshadowed by pollution in the past several years. More than half of survey participants report that the Covid-19 pandemic is positively affecting the public image of plastics, while nearly 40% say there is no impact. Only 6% see the image of plastics getting worse as a result of the pandemic.

Figure 1: Main concerns before and during the Covid-19 crisis, May 2020

About KI Group

With its subsidiaries Kunststoff Information Verlagsgesellschaft mbH, KunststoffWeb GmbH and Kunststoff-Profi Verlag GmbH & Co. KG, the KI Group has been providing decision makers in the German and European plastics industry with critical business information since 1971. The current range of services includes extensive online portals in German and English, print newsletters, the trade magazine K-PROFI, the official German-language newspaper K-AKTUELL for the leading plastics trade fair “K” in Düsseldorf. KI Group provides information comprising up-to-date prices for plastics, market reports, capacity databases, daily news, email alerts and newsletters and specialised analytical tools for price research. This is complemented by a wide range of services in consulting, training courses, seminars and market research on all aspects of plastics purchasing. Since its foundation, the KI Group has occupied a leading position in the field of polymer prices. With a unique network of producers, distributors and processors, it stays in close contact with hundreds of market players to gather price and market data. KI Group’s price indices are accepted throughout the industry and are included in the escalator clauses of countless supply contracts. More than 5,500 European companies already trust in our data and reports.

Press contact

Laura-Katharina Beresheim, Marketing Manager, laura-katharina.beresheim@kiweb.de